How we can stabilise our pharmaceuticals supply

After the pandemic is before the election: While Germany is coping with the most severe public health crisis in decades, politicians are getting ready for the next legislative period. What are the lessons learned from Covid-19 in terms of wide-spread medical care and nationwide provision and supply of pharmaceuticals?

Which challenges will politicians have to master? And what should the newly elected federal government address first from the perspective of generics manufacturers? Our suggestions can be found below as well as in our position paper (available to download in German).

Read more about what we have learned from the corona pandemic and what politicians should do now here.

The significance of generics in times of crisism

Covid-19 is an earthquake that fundamentally shook our health care system. That patients in Germany were able to receive the pharmaceuticals they need at any time during the pandemic is also an achievement of German generics manufacturers.

In the intensive care units (ICUs) of hospitals across Germany, both patients with chronic illnesses and Covid-19 patients benefitted from this: 69 of the 71 pharmaceuticals required at ICUs are generics.

It is therefore clear that generics manufacturers are building the bridge leading to the end of the pandemic. Up until the moment when finally enough people in Germany are vaccinated against Covid-19.

Supply with pharmaceuticals during the pandemic was an unprecedented feat of strength

In order to ensure security of supply with pharmaceuticals in Germany – especially in the first wave of the pandemic when supply chains were under extreme pressures and in large parts almost came to a standstill – a massive and unprecedented feat of strength of pharmaceutical manufacturers was needed. They increased their production capacities, organised expensive transports via air freight, and worked extra shifts in all areas. Moreover, workers were called back in from retirement an pragmatic solutions were found in cooperation with the authorities, e.g. to be able to deliver larger amounts of propofol for the intensive care units across Germany.

Most impressively, the member companies of Pro Generika successfully managed the entire stocking of pharmaceuticals for the second and third wave of infection. They did this at their own risk and at their own expense – without any support from the federal government.

Cause of the problem: cost pressures

For more than twenty years, health policy has been governed by an omnipotent dogmatic doctrine: saving costs. Especially primary health care – for which manufacturers of generics provide 78 per cent of pharmaceuticals – are more and more streamlined towards efficiency. In reality, generics manufacturers supply an ever-increasing amount of pharmaceuticals for an ever-decreasing share of the real pharmaceuticals expenditures of the German Statutory Health Insurance (GKV) – namely, 8,4 per cent.

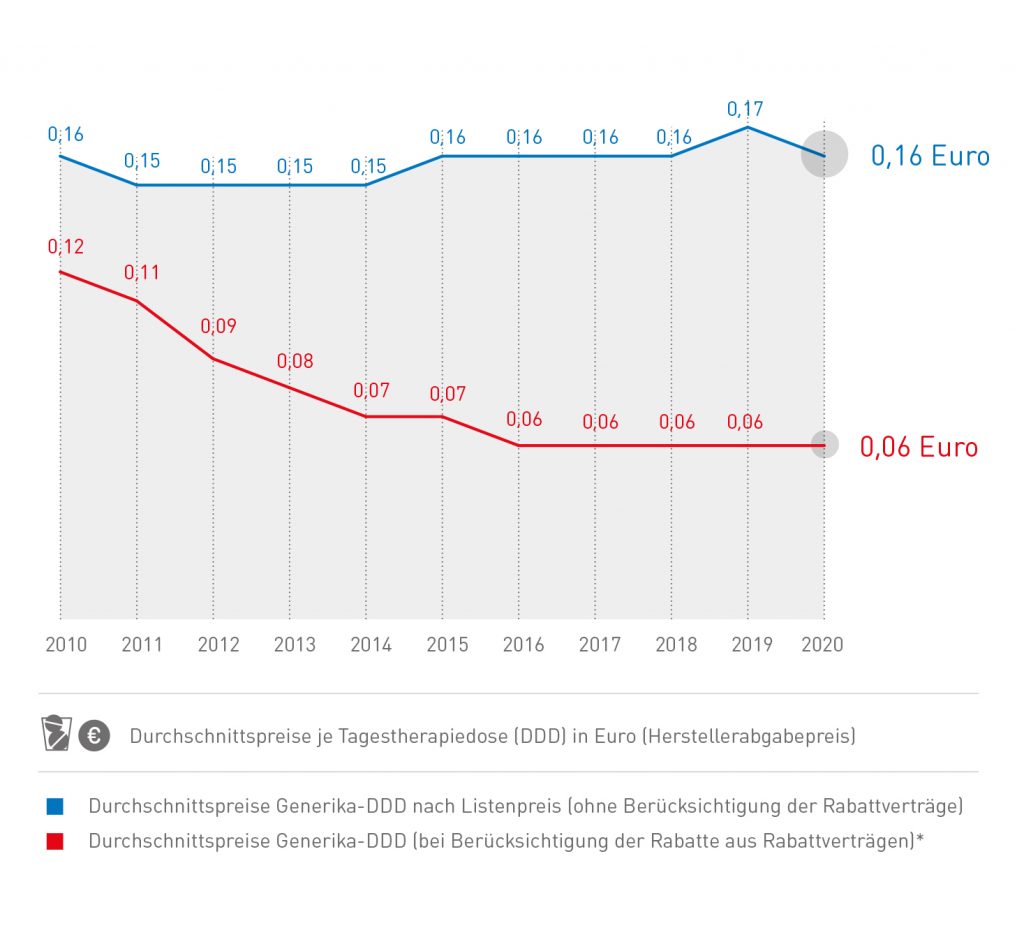

The share of generics in healthcare is increasing, the costs are decreasing

This development may be pleasing for the health insurance funds — at least at first glance: they pay the companies an average of only six cents for the daily dose of a generic drug.

The daily defined dosage of a generic costs 6 cents on average

Cost pressures destabilise security of supply

In terms of security of supply, this dogma is devastating as evidenced by the growing number of shortages. Due to the continuously increasing pressures on costs, companies and manufacturers have to streamline their supply chains for ever-increasing efficiency, they have to constantly analyse their product portfolios and search for preparations considered economically unfeasible and – e.g. when it comes to decisions over whether the API should be procured from Europe or Asia – it forces manufacturers to always chose the cheaper option, and thus choosing the Asian one.

What a decision like this looks like from the perspective of a company and why manufacturers are forced to buy the APIs in Asia in order to remain competitive on the market – has been explained by Christoph Stoller, managing director of Teva Germany, at the Pro Generika spring event.

Why I have to buy APIs from Asia (in German)

This development has led to massive dependencies

In particular

- the concentration on very few efficient suppliers (insufficient variety of suppliers), e.g. for important APIs

- the relocation of production away from Germany: while around 20 years ago roughly two thirds of APIs essential for primary health care were produced in Europe and a third in Asia, this ratio has completely turned into the opposite.

The shift of API certificates from Europe to Asia

The political understanding and policy insights already exist!

During the Corona crisis, many health politicians have realised the ways in which health care in Germany is dependent on countries outside of Europe. They have understood that primary care with pharmaceuticals is not a cost driver – instead it has been underfinanced for a long time.

Recently, member of the Bundestag Michael Hennrich (CDU) announced that this problem will finally be dealt with in the next legislative period.

Michael Hennrich (CDU): Why politics must step in now (in German)

In March 2020, Federal Health Minister Jens Spahn also emphasised that he wanted to shift the production of medicines and active ingredients back to Europe — even if this would lead to higher costs for generics.

The necessity of more sustainability in tendering agreements has been understood by many health insurance providers, as Dr. André Breddemann of BARMER health insurance announced at Pro Generika’s spring event 2021.

New political agenda set for the beginning of the new legislative period

What politics needs for the future is a new paradigm for health policy and legislation: instead of always focussing on more and more efficiency, the focus must be on security of supply from now on. For this, more robust supply chains and a stronger regional diversification – also via strengthening production in Europe – are indispensable.

For generics, the cornerstone of primary health care, there must not be any more additional legislative cost containment measures. The consequences for supply and therefore for patients would be fatal. Now the focus must be on measures pointing in the opposite direction.

More robust supply chains must be the aim

The focus must be on strengthening supply chains and making them even more resilient. Oftentimes these are 10,000 kilometres (~6,200 miles) and span across the entire globe. Because: the raw materials for a generic originate mostly from mainland China. API and finished pharmaceutical product, on the other hand, are largely manufactured in various factories in India. This can become a problem – as shown by the depiction of a typical supply chain.

From China to Germany: What the typical supply chain of a generic looks like

But what could happen for supply chains to become more stable again? To achieve this, companies must take several different measures. One possibility is to keep a second API source under contract, as supply chain expert Martin Schwarz explains in the video below. In this way, they have another supplier to fall back on in case of emergency. But: Holding a second API source readily available incurs costs which must be considered within the German pricing and reimbursement system. Otherwise investments of this kind cannot be made.

Dr. Martin Schwarz (supply chain expert): Why companies cannot just stabilise their supply chains (in German)

We need new tendering models with the health insurances

For the future it is therefore essential that tendering agreements and procedures of the health insurances must be adjusted. So-called one partner models might be cheaper for the health insurances, but they result in shortages much quicker.

Tendering agreements should therefore always include more than one company (i.e. „Mehrpartnermodell“, more partners model). In this way, the responsibility for security of supply rests on multiple shoulders.

Discount agreements:

Discount agreements:

- must therefore no longer solely reward those who offer maximum discounts, but must instead include and consider additional criteria (e.g. second API source)

- still every third contract is created in such a way by the health insurances that only one company must supply all people insured with this health insurance provider – this must finally come to an end and discount agreements must generally be given to more than one company since if there is only one manufacturer and they drop out or malfunction, there usually isn’t another one who can jump in at short notice and provide the entire load.

- Environment-friendly production is socially more and more desired – but, those who are serious about this must also reimburse additional investments made by companies for an even more environment-friendly production in Europe or elsewhere – so too in discount agreements and in the form of real boni.

At a glance: What you should know about generics!

Generics provide the main share of pharmaceuticals supply

They make up 78,8 per cent of pharmaceuticals (in terms of daily defined dosages). Their share of pharmaceuticals expenditure, however, only amounts to 8,4 per cent.

Generics are getting cheaper and cheaper

While manufacturers received an average of 12 cents per daily defined dosage for a generic in 2010, nowadays they merely receive 6 cents on average.

More and more generics are manufactured in Asia

Two thirds of our active pharmaceutical ingredients (API) originate from a handful of provinces in India and China. 20 years ago, the opposite was the case.

Discount agreements are price pressures

90 per cent of packaging units that are part of a discount agreement are generics