Generic medicines make up the vast majority of medicines that are needed every day in Germany. The production of the active ingredients of these medicines (APIs = active pharmaceutical ingredients) no longer takes place in Europe.

This is the result of a study conducted by the consultancy MundiCare on behalf of Pro Generika. It shows for the first time on the basis of facts: Europe has lost its former leading position.

Around two thirds of the approvals (=CEPs, Certificate of Suitability of Monographs of the European Pharmacopoeia) required for the production of active substances are now held in Asia, and more than half of the manufacturers are also based there. Important to know: An active substance can be produced by different manufacturers. So there can be several CEPs from different manufacturers for one API.

The main findings of the study:

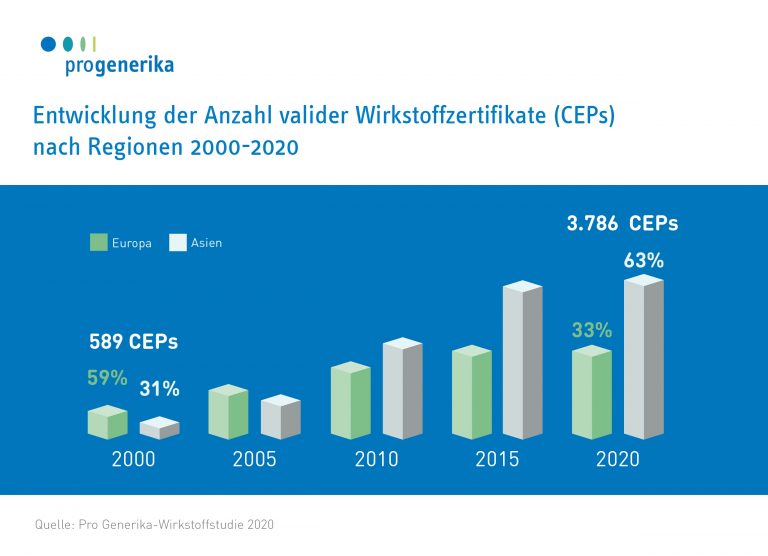

Dynamic growth and massive shifts in the market over the past 20 years: In contrast to the year 2000, around two-thirds of the active substance certificates (CEPs) are now held in Asia.

- The number of active ingredient certificates has increased fivefold between 2000 and 2020. Much of the growth is attributable to Asian market participants. The share of CEPs held there increased by more than 1,200 percent.

- For the year 2000, the database lists 589 CEPs, of which 59 per cent were held in Europe and 31 per cent in Asia.

- In 2020, the ratio will be reversed: 63 per cent will be held in Asia, only 33 per cent in Europe.

India and China play a special role

India and China play a special role

More than 80 per cent of all active substance approvals (CEPs) in Asia are held here.

- For example, almost 90 per cent of CEPs in India are located in just four states: Telangana, Maharashtra, Gujarat and Karnataka.

- The picture is similar in China. Here, almost three quarters of the CEPs are found in just five provinces in the east of the People’s Republic (Zhejiang, Shandong, Jiangsu, Hebei and Hubei).

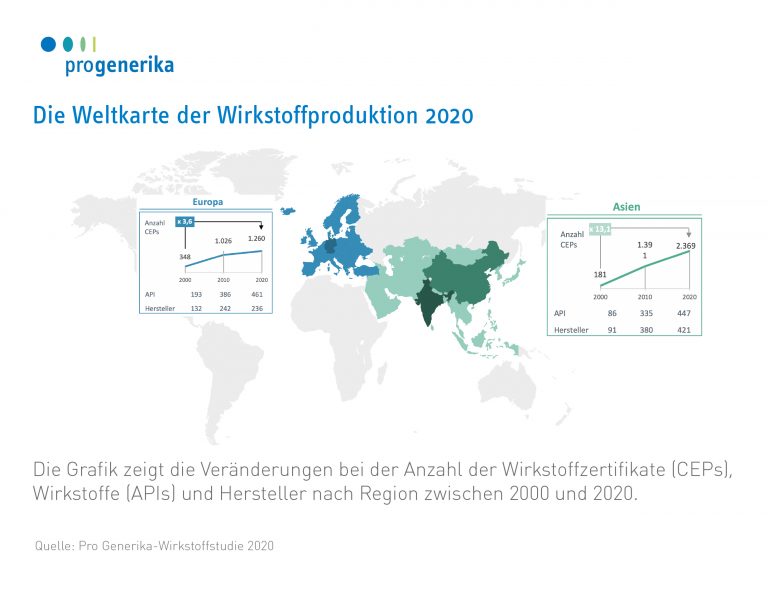

Not only in the number of CEPs, but also in the number of manufacturers that have CEPs for the EU, there is a clear shift in the individual world regions: Whereas in 2000, 132 out of 248 manufacturers (around 53%) were based in Europe, in 2020 this figure is only 236 out of 717 (around 33%). In Asia, the number of manufacturers has risen from 91 to 421 in the same period.

The detailed analysis of the data also proves that production is not only regionally concentrated, but for many active pharmaceutical ingredients (APIs) also limited to a few manufacturers.

The detailed analysis of the data also proves that production is not only regionally concentrated, but for many active pharmaceutical ingredients (APIs) also limited to a few manufacturers.

For more than half of the APIs, only five or fewer certificates are listed in the EDQM database. This means that for a large part of the APIs needed in Europe, only about a handful of manufacturers worldwide even have an API certificate.

The study shows three dependencies

These relate to the production of active ingredients and pose considerable risks to the supply of medicines:

- from non-European producers,

- from a few regions of the world,

- from a few manufacturers for the majority of the active ingredients needed.

An exemplary detailed analysis has also shown that the active ingredients that are particularly frequently needed come mainly from Asia. Dr Andreas Meiser, author of the study and Managing Director at MundiCare, summarises the results as follows: “Our study provides for the first time a fact-based overview of where the active ingredients needed in Europe come from. It shows why Europe has lost its dominant position in the production of active ingredients. And it makes clear that European supply is highly dependent — on only a few active ingredient manufacturers in very small parts of the world. This poses risks to the supply of medicines.”

In addition to the changes of the past decades, the study also shows potentials. After all, part of the active ingredient production — currently around 30 per cent — is still located in Europe.

A detailed analysis of the European demand for 21 exemplary APIs shows that today mainly APIs with a comparatively low production volume and/or a complex process are produced in Europe. Examples are tamoxifen — an active ingredient used in the treatment of breast cancer — or formoterol, an active ingredient used in the treatment of bronchial asthma and chronic obstructive pulmonary disease (COPD). Large-volume APIs tend to come from Asia. If the know-how needed for API production is to be maintained in Europe, consistent action is required.

An analysis of the individual active substances shows: The later an active ingredient went off patent in the past 20 years, the earlier the shift to non-European countries began. Bork Bretthauer, Managing Director of Pro Generika, emphasises the potential that the study shows: “The study also contains clearly positive news, because it shows us that active ingredients are still being produced in Europe, and on a significant scale. Politicians should now focus on strengthening the (still) existing production of active ingredients and medicines and on stopping further migration. The best way to do this is to change the framework conditions that led to the relocation to Asia in the first place. In concrete terms, this means: it must finally eliminate the extreme cost pressure on basic supplies and thus create scope for more resilience in the supply chains again.”

The research question Methodology of the study

The Pro Generika Active Substance Study has investigated where in the world the production sites of around 560 active substances are located that are in supply in Germany. In addition, the study identified 21 important active ingredients and determined the extent to which their European demand could also be manufactured in Europe. As a point of reference for the analysis, it chose the so-called CEPs (“Certificate of Suitability of Monographs of the European Pharmacopoeia”) as the most important form of active ingredient approvals. These certify a manufacturer’s ability to produce an active substance in the required quality. The CEPs are recorded in the public database of the “European Directorate for the Quality of Medicines and Healthcare” (EDQM). The study investigated generic active pharmaceutical ingredients (APIs) for which at least one CEP was available in the EDQM database as of 30 April 2020. The study was conducted by MundiCare Life Science Strategies on behalf of Pro Generika e.V.. It is called “Where do our APIs come from? A world map of API production”.

Download: Long Version — English / Short Version — English

Download: Short Version — German / Conclusion — German / chart

07.10.2020